Did you know that during the Great Depression, the unemployment rate in the United States soared to nearly 25%? Meanwhile, the GDP fell nearly 30%. These figures show the huge impact of an economic depression on a country’s economy. Unlike a normal economic downturn or recession that lasts a few months, an economic depression is much worse. It’s a severe and prolonged decline in economic activity that can last for years.

What exactly does economic depression mean? It’s more serious than a recession, which happens when the GDP drops for two consecutive quarters. Economic depressions mean long times of no growth with big problems for jobs, people’s confidence, and overall production. Knowing the difference is important for everyone and policy makers as they deal with complex economic issues. For deeper understanding, check out this Informative article about economic depressions.

Key Takeaways

- An economic depression is more severe and prolonged than a recession.

- The Great Depression lasted from 1929 to 1941, highlighting the long-term impacts of such downturns.

- High unemployment and reduced GDP are key indicators of prolonged economic distress.

- Preventive measures by governments can help mitigate risks of future depressions.

- Understanding the signs of an impending depression is crucial for proactive policymaking.

Understanding Economic Depression

Economic depression means the economy is in deep trouble for a long time. It faces tough times, with production and jobs dropping sharply. It’s important to understand how this affects things.

Definition of Economic Depression

Economic depression is when the economy shrinks by more than 10% for over three years. For example, during the Great Depression, the economy shrank by about 30% from 1929 to 1932. This was a long-lasting impact, causing unemployment to jump over 20%.

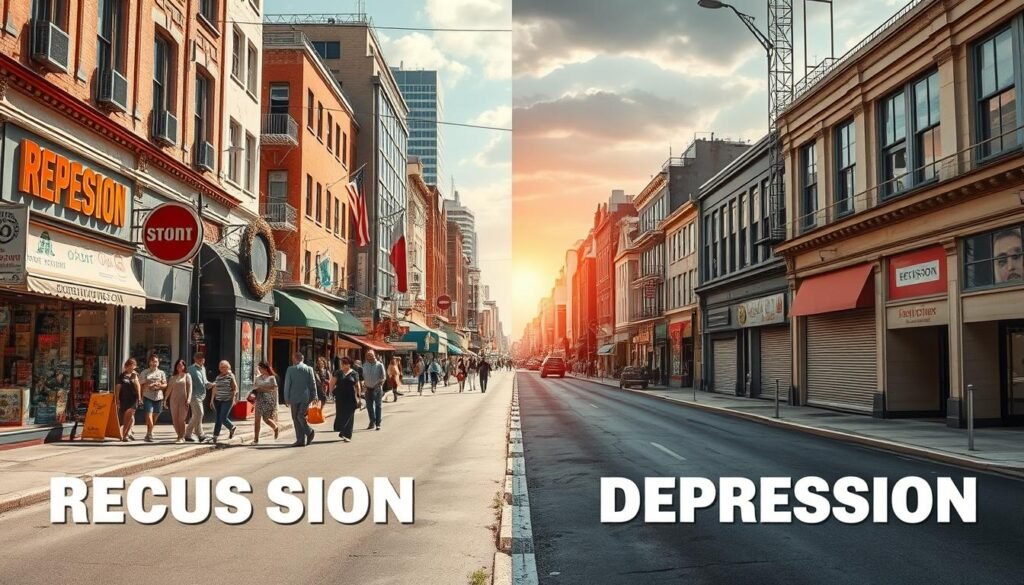

Comparison with Economic Recession

Depression and recession show different kinds of economic downturns. Recessions happen more often, last a short time, and usually, GDP goes down less than 10%. But depressions are rare, last years, and hurt more.

Depressions lead to defaults, many bankruptcies, and a big drop in investment and trust from consumers. Knowing these differences helps us understand the impact on society and the world’s economy.

What Does Economic Depression Mean

Getting a clear understanding of economic depression is key to seeing its effects on society. These depressions come with distinct features that set them apart from other economic lows. It’s important to know these traits to figure out how long and bad they might be.

Characteristics of Economic Depression

What makes an economic depression? Big drops in what people and businesses spend. This leads to consumers having less money compared to what’s available to buy. Also, high unemployment rates show how tough depressions can be. For example, during the Great Depression, unemployment in the U.S. hit 25%.

Companies might cut costs when the economy slows. This often means they lay off workers, leaving more people looking for jobs.

Duration and Severity

Depressions last longer than usual recessions, often going on for years. This time can be marked by very little economic growth. It makes it hard for countries to get back to how they were before.

The seriousness of a depression is clear when there’s a huge fall in real GDP. A depression is often defined as a 10% drop. For instance, the Great Depression saw a 33% drop in the U.S. economy, showing just how severe these events can be.

| Characteristic | Description |

|---|---|

| Consumer Spending | Significant decreases that lead to reduced demand for goods and services. |

| GDP Decline | A drop in real GDP exceeding 10% often defines an economic depression. |

| Unemployment Rates | Unemployment often rises substantially; e.g., 25% during the Great Depression. |

| Duration | Economic depressions typically persist for several years. |

| Business Activity | Sustained contractions in manufacturing orders signal the potential for deeper economic issues. |

Consequences of an Economic Depression

Economic depressions impact both the economy and society hugely. Impact on GDP during these times is significant. Historically, like in the Great Depression, GDP fell nearly 30%. This big drop makes the economy less active. Businesses scale back, and trade decreases.

Impact on GDP and Economic Activity

Depressions affect more than just numbers. They lower consumer spending and investment. This weakens economic activity, making recovery hard. It becomes a vicious cycle, where less activity means more GDP declines. To learn more, see the difference between recessions.

Unemployment Rates during Depression

Unemployment rates skyrocket during depressions. In 1933, during the Great Depression, about 24.9% were unemployed in the U.S. This shows how badly economic declines affect jobs. Those still working had big pay cuts, losing around 42.5% of their income.

Poverty Rates and Financial Hardships

Economic problems lead to higher poverty rates. Families face unemployment and less money. Many struggle to buy food or get basic services. These effects can last across generations. To deal with these challenges, saving money and using credit wisely helps. For more, check out economic depression resources.

| Indicator | Great Depression Data | Current Scenario |

|---|---|---|

| Unemployment Rate | 24.9% | Varies, generally below 5%* |

| GDP Decline | ~30% | Varies based on recession* conditions |

| Average Duration | Several years | Around 1 year* |

The Great Depression: A Historical Example

The Great Depression stands out as a key moment in economic history. It started in the United States but soon affected the world. From 1929 to 1939, a series of events led to a severe economic crisis.

Origins of the Great Depression

The trouble began with the 1929 stock market crash, caused by too much speculation and economic imbalance. The crash showed flaws in the financial system. This led to widespread unemployment and poverty. The Federal Reserve made things worse by raising interest rates in 1928 and 1929. This slowed the U.S. economy down. These problems didn’t just affect the U.S.; they had a global impact.

Impact on the US and Global Economy

The Great Depression hit the US economy hard. Industrial production and the real GDP fell drastically. Unemployment rates went over 20%, deeply affecting American families. Europe, especially Great Britain and Germany, also struggled economically. Japan and Latin America felt it less, showing the Depression’s wide impact.

World markets suffered as the prices of goods like coffee and cotton halved from 1929 to 1930. Recovery in the U.S. began in 1933. The economy grew fast for a few years after. Yet, the Depression’s effects lasted for decades, shaping future economic policies.

Economic Indicators of Depression

Economic indicators are vital for assessing an economy’s health. In tough times, certain signs stand out. They shed light on deeper issues. A drop in consumer confidence makes people spend less. This change impacts the entire economy.

Businesses also feel the uncertainty. They might stop investing or delay growing their operations. This leads to higher unemployment rates. It shows the economy is struggling.

Decline in Consumer Confidence

When people feel less confident, they hesitate to buy things. This hesitation affects businesses and the whole economy. Saving becomes more important than spending. This change is a crucial signal of economic downturns.

Decreased Corporate Investment

Companies often pull back on investments when the future looks uncertain. A drop in investment shows they doubt the economy will grow. This pause in projects slows innovation and economic growth. The situation gets worse.

Rising Unemployment Rates

Unemployment rates go up when the economy is down. Jobs become scarce as companies cut back or shut down. This increase in unemployment hurts not just those who lose their jobs. It also burdens social services and the economy. Rising unemployment is a clear sign of trouble.

| Economic Indicator | Impacts |

|---|---|

| Consumer Confidence | Leads to reduced spending and affects overall economic activity. |

| Corporate Investment | Declines under uncertainty, leading to halted expansion and innovation. |

| Unemployment Rates | Increase sharply, creating a broader economic strain and reduced consumer spending. |

Differences Between Economic Recession and Depression

When we talk about differences recession depression, we’re exploring two economic terms. Both indicate a drop in economic health, but they’re not the same. They vary by length, severity, and their effects on people’s lives.

Defining a Recession

A recession describes a time when the economy shrinks for six months. On average, recessions last about 17 months, says the National Bureau of Economic Research (NBER). They usually hit some areas or sectors harder than others. During the Great Recession, the economy took a big hit. But it was more of a sharp downturn than a long-term disaster. Economies often start to recover from recessions in a few years.

Length and Severity of Each Condition

Depressions, on the other hand, go on much longer and hit harder. The Great Depression, from 1929 to 1941, saw a huge 30% drop in the economy. Unemployment shot up to 25% by 1933, crushing demand and having lasting effects. Depressions don’t happen often, but when they do, they’re more severe than recessions. They damage employment and long-term economic health, shaking confidence deeply.

| Feature | Recession | Depression |

|---|---|---|

| Definition | Decline in GDP for two consecutive quarters | Prolonged economic downturn, often exceeding 10% decline in GDP |

| Duration | Averages around 17 months | Lasts for a decade or more |

| Severity | Localized impact | Widespread, significant societal effects |

| Historical Example | The Great Recession (2007-2009) | The Great Depression (1929-1941) |

| Unemployment Rate | Typically rises but generally below 10% | Can exceed 25% |

Understanding the differences recession depression is key for those making policy. They can better plan and respond to economic troubles. For more info on these terms, check this link.

Signs of an Impending Economic Depression

Knowing the signs of an upcoming economic depression helps us take action. We need to watch different areas to spot trouble early.

Understanding Economic Downturns

Economic downturns don’t happen overnight. They show warning signs. Spotting these signs early is key to managing risks.

Rising unemployment, less consumer spending, and lower business investments are warning signs. When trade slows down and people spend less, it usually means trouble.

Monitoring Key Economic Indicators

Watching key indicators helps us understand what’s happening. Here are important signs to look for and what they mean:

| Indicator | Signs of Depression | Implications |

|---|---|---|

| Unemployment Rates | Increased unemployment | Loss of disposable income and reduced consumer spending |

| Consumer Confidence | Declining confidence | Decreased spending on goods and services |

| Corporate Investment | Lower investments | Reduction in job creation and economic growth |

| Trade Activity | Reduced exports and imports | Negative impact on GDP growth |

| Stock Market Trends | Declining stock prices | Heightened investor anxiety and reduced capital for businesses |

Staying alert to these signs helps governments and banks take action. They can help prevent big economic problems.

How Depressions Impact Society

Economic depressions greatly change society. They alter how people act and sway political matters. These changes happen on different levels. They lead to personal changes and wider shifts in society.

Behavioral Changes During Economic Crisis

During hard economic times, people change how they act. Many become more careful with money, saving more than they spend. This is seen as people begin to:

- Reduce spending on things they don’t need.

- Look for extra ways to make money, like part-time jobs.

- Pay more attention to managing their finances.

These shifts show a society trying to get through tough times. The impact on society grows as these habits become normal.

Political and Social Ramifications

Economic crises also have big political effects. People struggling financially often want the government to do more. This leads to various outcomes, including:

- A stronger push for government help and welfare programs.

- More people getting involved in politics to seek changes.

- The risk of protests due to unhappy citizens.

When economic and social issues mix, it can lead to big changes in how a community runs. Sometimes, this even leads to changing how the government works, driven by what people need. In short, the impact of a depression goes way beyond money. It changes how society operates, impacting culture and politics for a long time.

Preventing Future Economic Depressions

It’s crucial to take steps ahead of time to avoid depressions. Governments play a big role in keeping the economy stable and helping it recover. By using policies that grow the economy, governments can help create jobs. They can also provide financial help to people when times are tough. Alongside, central banks make adjustments. These can stimulate growth.

Role of Government Policy

Government policy is key in stopping economic downturns. When a financial crisis hits, quick action can lessen the fallout. These actions may include:

- Stimulus packages to boost consumer spending

- Infrastructure investments to create jobs

- Tax relief for individuals and businesses

These efforts boost the economy right away. They also prepare a base for steady growth later. By making and carrying out these policies, governments help in keeping depressions at bay.

Actions by Central Banks

Central banks help prevent economic chaos through careful monetary moves. Primary actions include:

- Reducing interest rates to encourage borrowing

- Implementing quantitative easing to increase money supply

- Targeting inflation to avoid deflationary spirals

Actions by central banks support growth and investment. This is crucial for bouncing back economically. Working together, central banks and governments can manage economic risks. This helps in dodging future depressions.

| Measure | Purpose | Potential Impact |

|---|---|---|

| Fiscal Stimulus | Boost consumer spending | Increased demand, job creation |

| Infrastructure Investments | Create employment | Long-term economic growth |

| Interest Rate Cuts | Encourage borrowing | Stimulated economic activity |

| Quantitative Easing | Increase money supply | Support lending and investments |

Creating a plan that includes both government and central bank efforts is important. Such a two-part strategy is vital. It builds strength in economies worldwide and helps avoid depressions.

Conclusion

Understanding economic depression is vital. It helps us navigate through tough economic times. Knowing its effects helps us see how it impacts us and society.

This highlights why we must keep an eye on economic signs. They show us if a downturn is coming.

The Great Depression teaches us a lot. It shows the bad effects, like high unemployment and low company profits. This teaches us the long-term consequences of an economic downturn.

Policymakers must act wisely to keep us strong and stable. By learning from the past, we can prepare for future problems.

We must understand how government actions and trade policies play a role. This knowledge helps us deal with future economic depressions better. It can make recovering from crises easier for everyone.